To coin a cliché: the steel market sector is currently going through unprecedented times. Already hindered by poor trading amidst sour relations between the United States and China, steel manufacturers were suddenly saddled with dramatic supply chain issues off the back of a global pandemic.

Understanding the Steel Market Sector Status Quo

Steelmakers are no strangers to challenges of supply and demand. Since the onset of industrialised rolling in all major markets worldwide, overcapacity has been a routine occurrence. This was exacerbated by large-scale mass production of comparatively cheap steel products from the Asia Pacific markets – primarily China.

Asia Pacific Steel Market Sector

China is now by far the world’s largest producer of crude steels, with several large state-owned enterprises accounting for over half of the world’s annual output. In August 2020 alone, Chinese steelmakers turned out approximately 95 million metric tons of crude steel. This was part of a general steel market sector rebound after the easing of lockdown restrictions combined with the end of the monsoon season, which typically signals an uptick in construction.

Japan is the other major player in the Asia Pacific steel market sector, but they haven’t experienced a similar economic rebound. The Japanese market was already suffering from low demand pre-pandemic, and with almost one-third of the country’s blast furnace operations halted since the economic slowdown, estimates suggest that the country’s entire output is likely to fall below 80 million tons this year.

The EU Steel Market

Second only to China in terms of steel production is the European Union (EU), which – of course – has an additional cross-border dimension to consider when evaluating the steel market sector position. The European Commission counts 500 different production sites divided over 23 EU countries, all accounting for over 177 million tonnes of steel produced per annum. Most of this goes into construction (35%) or automotive engineering (19%), each of which has experienced a significant economic slowdown due to the current crisis.

The benefit of the EU is its broad regulatory framework which enables the development and sustaining of a secure internal market. EU initiatives aimed at driving these key markets are underway. However, unlike China, few EU member states have an abundance of raw materials, so additional considerations need to be made towards increasing trade.

United States Steel Market Sector

The situation facing the United States (US) steel market sector is arguably more complex than in either China or the EU. With the current presidential administration aiming to stamp out overcapacity in steel production through aggressive trade tariffs. Before the pandemic, American manufacturers were already saddled with rising costs off the back of harsh aluminium and steel tariffs which accounted for a price increase of almost 16% for hot- and cold-rolled steel.

Yet there are reasons to be cautiously optimistic across the board, as the global economy gradually shows signs of stabilising and even nascently improving. Rising construction and production demands should inevitably force manufacturers in all regions to step-up supplies.

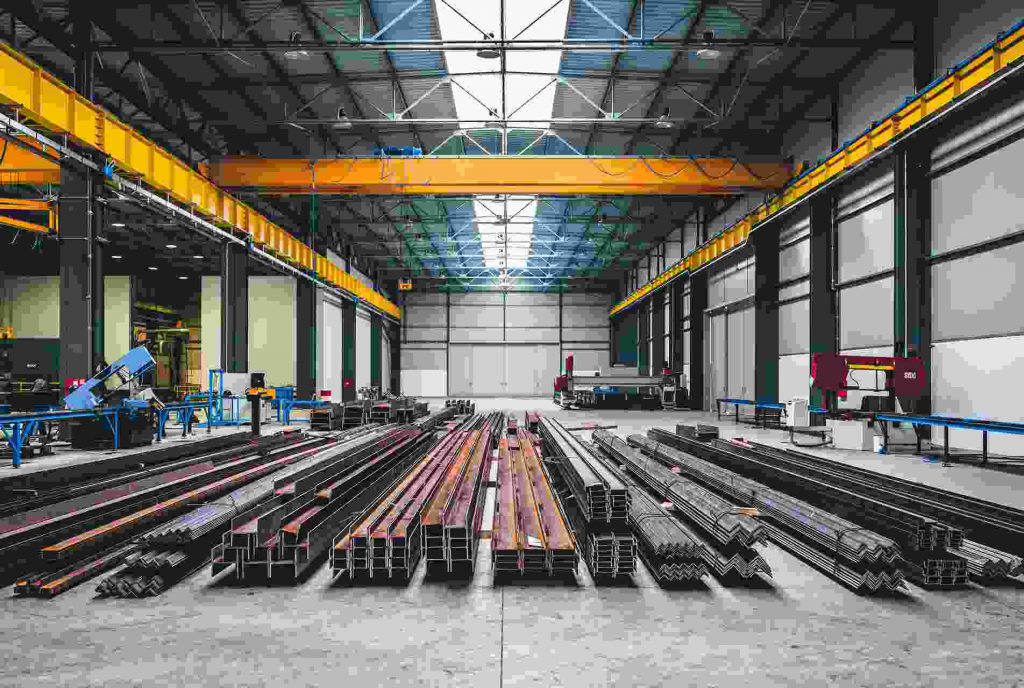

Contact us for hot- and cold-rolled steel products

Sources:

https://www.statista.com/statistics/640516/steel-usage-industry-sectors-eu28/

https://www.statista.com/topics/1149/steel-industry/

https://www.japantimes.co.jp/news/2020/08/04/business/corporate-business/japan-steel-mills/

https://ec.europa.eu/growth/sectors/raw-materials/industries/metals/steel_en